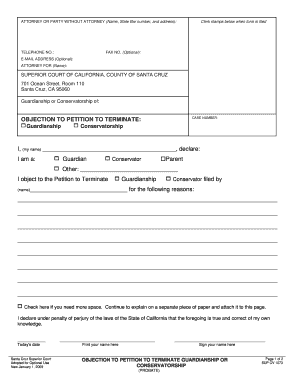

CA DE-165 1998-2025 free printable template

Get, Create, Make and Sign representative personal objection form

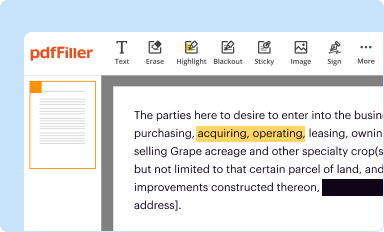

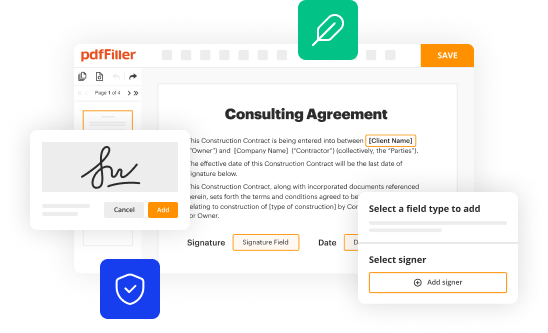

Editing form de 165 online

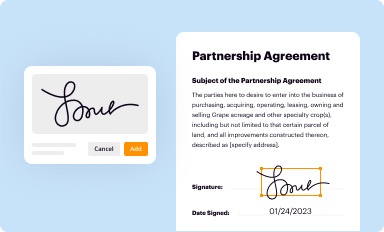

How to fill out de 165 form

How to fill out CA DE-165

Who needs CA DE-165?

Video instructions and help with filling out and completing notice of proposed action de 165

Instructions and Help about probate form de 165

Hey speak yeah we should go okay like right now see you got explosives I'm pretending to mask that bottom line here Mike this whole business he's a little Michael Western and gun sound plenty of guns mushroom how professional send a message being bigger can't be on pain medication I'm going to be in situations I'm going to be in Hank Sam I would tell you the reason I drink Mikey I don't know what to say I'd say nothing's good let's go with nothing scoot over ah no can do boss my ass dildo kicker he kisses make it up warming I wake it up yeah did the idea was that she'd feel more comfortable talking doing one I'm not sure if he counts Mike very strategic Museum yes Victoria to my brain circles give me a back backers race little more you got something on and that's not got something 5k I missed nothing happened to him maybe I can get out of this for yogurts three yoga I actually had one blueberry dope a couple of guns and yogurt lots of yogurt don't ask me watch we all good your life Lutheran yogurt no big secret just love yogurt I'm crazy busy I need to finish my yogurt I need a good mojito that's right would you put some pants on what I work better when I can breathe them Mike honey fit in his little shirt for like doll clothes don't point well you know what they say about holding a snake by the tail Mike I think it's a tiger by the tail Sam yeah well either way you let go of it before eat your face up I'm glad you're out of the place didn't sound healthy

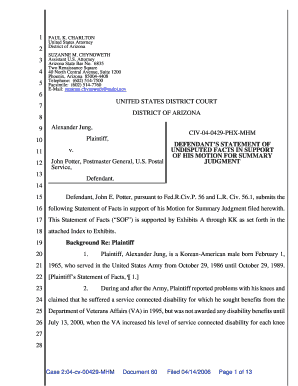

People Also Ask about de notice action

What does form I-797C Notice of Action mean?

Can I enter the U.S. with I 797 Notice of Action?

What is a notice of action?

What happens after I receive my form 1 797C notice of action?

What is i 797 approval notice?

What happened after receiving I-797C?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my california form 165 directly from Gmail?

How do I edit action property notice in Chrome?

How can I fill out de165 on an iOS device?

What is CA DE-165?

Who is required to file CA DE-165?

How to fill out CA DE-165?

What is the purpose of CA DE-165?

What information must be reported on CA DE-165?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.